Clean Rebate California – California Rebates give residents numerous incentives that help residents reduce their expenses and environmental impact. This guide is comprehensive and will cover the most popular rebates for electric vehicles, solar energy as well as energy efficiency and conservation of water, as well as programs that can be used to them. Find out about eligibility requirements and how to apply, as well as tips to maximize your savings.

Solar Rebates

- California Solar Initiative (CSI)

California Solar Initiative is a state-level incentive program that offers incentives to solar energy system installation on residential and commercial properties. The goal of the program is to encourage solar energy as well as reduce greenhouse gases emissions. Incentive payments are contingent upon system performance, and can cover up 30% of the cost of installation.

- Federal Investment Tax Credit (ITC)

The Federal Investment Tax Credit (ITC) gives you an additional tax credit of 26% on the price of solar systems to commercial and residential properties. If the credit is not utilized to the fullest extent the credit is able to be claimed on your federal tax return.

- Net Energy Metering (NEM)

Net Energy Metering (NEM), which is a bill arrangement permits solar energy system owners to get credit for excess electricity that the system generates. The credit is then used to offset electricity expenses when power is low.

Electric Vehicle Rebates

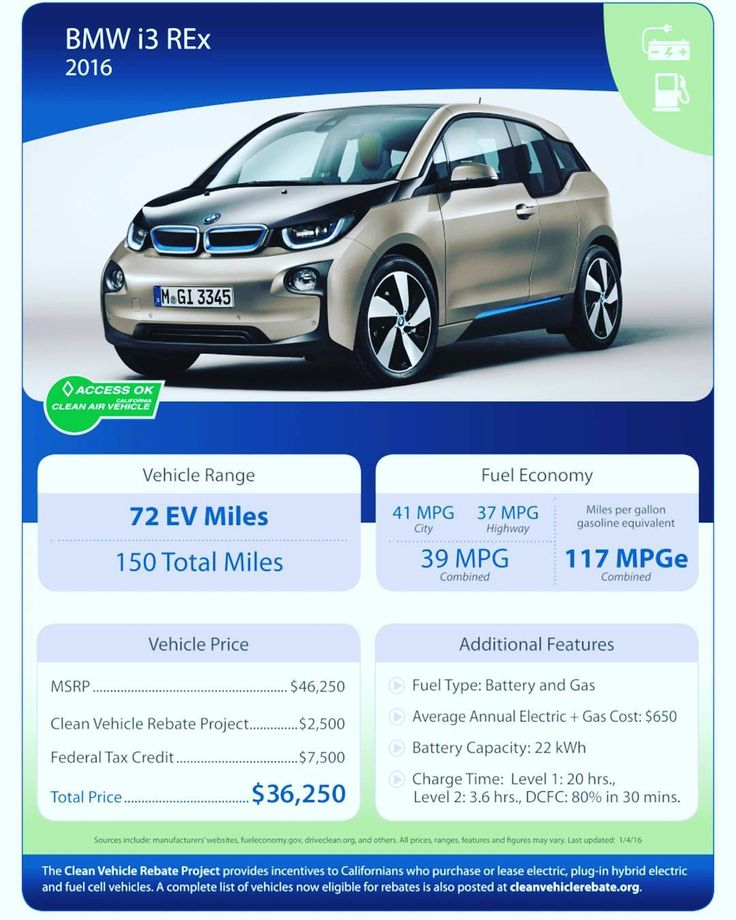

- Clean Vehicle Rebate Project (CVRP)

California’s Clean Vehicle Rebate Project offers rebates on eligible electric vehicles (EVs) purchased or leased. Reward amounts can vary from $2,000-$4,500 depending on the household’s income and the vehicle.

- Federal Tax Credit for Electric Vehicles

For qualified EVs that are eligible, the Federal Tax Credit for Electric Vehicles offers a tax credit of up to $7,700. The amount of the credit depends on the capacity of the vehicle and sales.

Energy Efficiency Rebates

- Home Energy Renovation Opportunity.

California homeowners can avail the Home Energy Renovation Opportunity Program (HERO) which offers funding for energy efficiency as well as renewable energy. The program is low-interest and long-term. It can be repaid with property taxes.

- Energy Upgrade California

California’s Energy Upgrade California is an initiative that provides incentives to homeowners to invest in energy-efficient upgrades to their home. The kind of improvements you’re planning to make will determine the amount of rebates that are available. They can be as little as a few hundred dollars up to several thousand. Insulation as well as high-efficiency cooling and heating systems, as well as energy-efficient windows are all eligible improvements.

Water Conservation Rebates

- Turf Replacement Rebate

California residents are eligible for financial incentives under the Turf Replacement Rebate program. This program grants financial incentives to those who are able to replace their water-intensive lawns by drought-tolerant landscaping. Rebates start at $2 per square feet of turf replacement and could help in reducing consumption of water and maintenance costs.

- Water-Efficient Landscapes Rebate

Water-Efficient Landscapes Rebate provides incentives for irrigation systems that use less water and rainwater capture devices. Rebates may be available depending on the kind of project or type and could assist in reducing costs associated with creating greener landscapes.

Conclusion

California Rebates offer many ways for residents to save time and also help the environment. The rebates are a great way to decrease your environmental footprint and offer significant financial benefits. Be sure to research the eligibility requirements for each program and application procedures and talk to professionals who can help you through the process.