California Solar Tax Rebates – California Rebates offer a wide range of incentives to residents who are aimed at saving the cost of their energy and lessening their impact on the environment. This comprehensive guide will explain the most popular rebate programs for solar power and electric vehicles. This guide will assist you to understand the eligibility requirements as well as how to apply and what tips can be employed to maximize savings.

Solar Rebates

- California Solar Initiative (CSI)

California Solar Initiative is a state-wide incentive program which provides financial incentives to solar energy systems that are installed on commercial and residential properties. This program has two objectives to encourage the use of solar energy and reduce greenhouse gas emissions. Incentive payments are based upon system performance, and are able to cover up 30% of the installation costs.

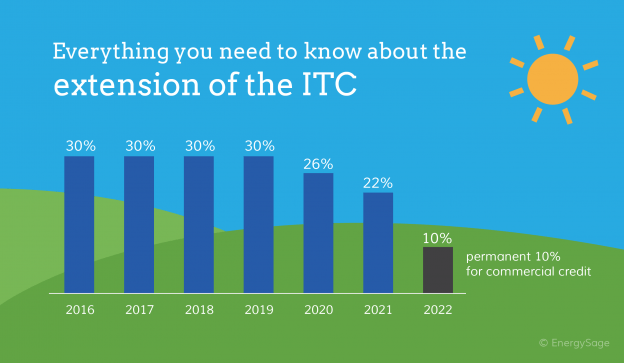

- Federal Investment Tax Credit (ITC)

Federal Investment Tax Credit offers 26% tax credit towards the cost of commercial and residential solar energy systems. The credit can be claimed on your federal income tax return and can be carried forward into future tax years, even if it is not used to its fullest capacity during the first year.

- Net Energy Metering (NEM)

Net Energy Metering (NEM), which is a bill arrangement permits solar energy system owners to receive credit for excess electricity their system generates. The credit can be used to offset electricity costs when the system isn’t generating enough power.

Electric Vehicle Rebates

- Clean Vehicle Rebate Project (CVRP)

California’s Clean Vehicle Rebate Project provides incentives for the purchase or lease of eligible electric cars (EVs). Rebates range from $2,000 to $4,500, based on the vehicle and the household’s income.

- Federal Tax Credit for Electric Vehicles

The Federal Tax Credit for Electric Vehicles provides tax credits of up to $7500 when buying eligible EVs. The amount of credit is contingent on the capacity of the vehicle and the sales.

Energy Efficiency Rebates

- Home Energy Renovation Opportunity (HERO) Program

California homeowners are eligible for the Home Energy Renovation Opportunity program that provides financing to improve energy efficiency, renewable energies as well as water conservation. The program provides low-interest, long-term financing which is also repaid through taxes on property.

- Energy Upgrade California

California is home to the Energy Upgrade California initiative. This is a comprehensive state program which offers homeowners incentives to make energy efficient home improvement. The kind of improvements you are looking to make can affect the amount of rebates you can avail. They can vary from few hundred dollars to several thousand. Examples of eligible improvements are insulation, high-efficiency heating, cooling, and energy efficient windows.

Water Conservation Rebates

- Turf Replacement Rebate

California residents who can replace their lawns that have been stricken by drought with drought-tolerant landscaping may be eligible for financial incentives through The Turf Replacement Rebate program. Rebates start at $2/square foot and can help reduce the use of water.

- Water-Efficient Landscapes Rebate

The Water-Efficient Landscapes Rebate program provides incentives for installing water-saving irrigation systems, rainwater capture devices, and other landscaping features that use less water. Rebates are available based on the type or project and could aid in the creation of greener landscapes.

Conclusion

California Rebates are an excellent way for residents to save money, as well as reduce their environmental footprint. Benefit from these water conservation incentives and have significant financial savings. It is possible to maximize savings by analyzing the eligibility criteria for each program before applying processes. Professionals are available to guide you through the process.